SAA floats possibility of selling Heathrow slots to fund fleet expansion

Company

Legal Links

Contact

- +44 7947 753363

- contact@skylineairporttransfers.co.uk

- 6 Walsall Street Bilston Wolverhampton WV14 0AT

© Skyline Airport Transfers. Created by![]() Beaphoenix WebDesign ltd

Beaphoenix WebDesign ltd

Popular Locations:

Birmingham: Aston, Bournville, Edgbaston, Erdington, Great Barr, Hall Green, Handsworth, Harborne, Northfield, Quinton, Soho, Sutton Coldfield, Amblecote, Brierley Hill, Coseley, Cradley, Gornal, Halesowen, Kingswinford, Lye, Netherton, Sedgley, Stourbridge, Quarry Bank, Bearwood, Blackheath, Cradley Heath, Great Bridge, Old Hill, Rowley Regis, Smethwick, Tipton, Tividale, Wednesbury, West Bromwich, Balsall Common, Bickenhill, Castle Bromwich, Chelmsley Wood, Dorridge, Elmdon, Hampton in Arden, Kingshurst, Knowle, Marston Green, Meriden, Monkspath, Hockley Heath, Shirley, Aldridge, Birchills, Bloxwich, Brownhills, Darlaston, Leamore, Palfrey, Pelsall, Pheasey, Shelfield, Streetly, Willenhall, Bilston, Blakenhall, Bushbury, Compton, Ettingshall, Heath Town, Oxley, Penn, Tettenhall, Wednesfield, Burntwood, Lichfield, Cannock, Rugeley, KIDDERMINSTER, Brierly Hill,

STOURPORT-ON-SEVERN

Coventry: Allesley, Binley, Keresley, Stoke, Tile Hill

Leicester: Abbey Rise, Ashton Green, Aylestone, Beaumont Leys, Bede Island, Belgrave, Blackfriars, Braunstone, Braunstone Frith, Bradgate Heights, Clarendon Park, Crown Hills, Dane Hills, Evington, Evington Valley, Eyres Monsell, Frog Island, Goodwood, Hamilton, Highfields, Horston Hill, Humberstone, Humberstone Garden, Kirby Frith, Knighton, Mowmacre Hill, Netherhall, Newfoundpool, New Parks, North Evington, Northfields, Rowlatts Hill, Rowley Fields, Rushey Mead, Saffron, Southfields, South Knighton, Spinney Hills, Stocking Farm, Stoneygate, St. Matthew’s, St. Mark’s, St. Peters, Thurnby Lodge, West End, West Knighton, Western Park, Woodgate

Derby: Matlock, Ripley, Ashbourne, ILKESTON, SWADLINCOTE , BURTON-ON-TRENT, BAKEWELL,

ALFRETON, BELPER, HEANOR

Telford: Market Drayton, Newport, Shifnal, Broseley, Much Wenlock

Stoke: Stoke-on-Trent, Newcastle, Leek, Uttoxeter, Stone, Stafford

Worcester: Worcester, Droitwich, Pershore, Broadway, Evesham, Malvern, Tenbury Wells

Gloucester: Gloucester, Cheltenham, Stroud, Cirencester, Tewkesbury, Badminton, Berkeley, Blakeney, Chipping Campden, Cinderford, Coleford, Drybrook, Dursley, Dymock, Fairford, Lechlade, Longhope, LydbrookLydney, Mitcheldean, Moreton-in-Marsh, Newent, Newnham, Ruardean, Stonehouse, Tetbury, Westbury-on-Severn, Wotton-under-Edge.

Nottingham: Nottingham, Sutton-in-Ashfield, Mansfield, Newark, Southwell, Grantham, Sleaford

Leicester: Leicester, Hinckley, Loughborough, Melton Mowbray, Oakham Market, Harborough, Lutterworth, Wigston, Ashby-de-la-Zouch, Ibstock, Markfield

Oxford: Oxford, Kidlington, Chipping Norton, Thame, Wallingford, Didcot, Wantage, Abingdon, Banbury, Carterton, Woodstock, Bicester, Witney, Chinnor, Watlington

Chester: Chester, Deeside, Bagillt, Buckley, Holywell, Birkenhead, Preston, Wallasey, Wirral, Neston, Ellesmere Port, Prenton

Airports we serve:

BHX: Birmingham Airport

EMA: East Midlands Airport

LHR: London Heathrow Airport

MAN: Manchester Airport

LGW: London Gatwick Airport

LTN: London Luton Airport

SOU: Southampton Airport

BRS: Bristol Airport

LPL: Liverpool John Lennon Airport

LCY: London City Airport

STN: London Stansted Airport

South African Airways has raised the possibility of selling slots at London Heathrow in order to help address the airline’s financial pressures.

SAA is government-owned and has been forced to revise its business strategy after a long-running attempt at privatisation collapsed earlier this year.

The carrier’s chair, Derek Hanekom, told a parliamentary public accounts committee meeting on 22 October that SAA had emerged from business rescue, in September 2021, a “seriously weakened airline”, but there had since been “steady growth”.

He says, however, that the carrier needs a cash injection to expand and develop after the failed privatisation.

SAA has two slots at Heathrow – one leased to British Airways and the other to Qatar Airways – and Hanekom told the committee that, even when SAA was “in its heyday”, only one of its slots was being used.

“This has to be a consideration – and this a discussion we’ll have with the shareholder – the possibility of monetising, of taking one of the slots at least,” he says.

“Even when we were flying when we had many routes, many flights to London, we were only using one of these landing slots. The possible disposal of one of the landing slots would obviously be a useful capital injection in the enterprise.”

Hanekom says the slot lease to Qatar Airways expires at the end of March 2025, and SAA has to decide whether the sale of the slot – which could provide capital for purchasing additional aircraft – would generate greater value than the slot rental.

SAA is flying around 16 aircraft, he states, and aims to have 21 next year. He stresses that the carrier is expanding the fleet according to the network demand, and “not just acquiring aircraft”.

Referring to remarks during the meeting about whether SAA could be brought back to its “former glory”, Hanekom states: “The only way we’d be able to do that is with serious investment in the airline.”

But he adds: “It should be borne in mind that ‘former glory’ was a little bit misleading. You can have a big airline, but when you – year after year – are showing a loss, it becomes an accumulated loss. And who takes on the burden of that loss? The taxpayer.”

Source link

Share This:

skylinesmecher

Plan the perfect NYC Memorial Day weekend

Pack only what you need and avoid overpacking to streamline the check-in and security screening…

LA’s worst traffic areas and how to avoid them

Consider using alternative routes, such as Sepulveda Boulevard, which runs parallel to the 405 in…

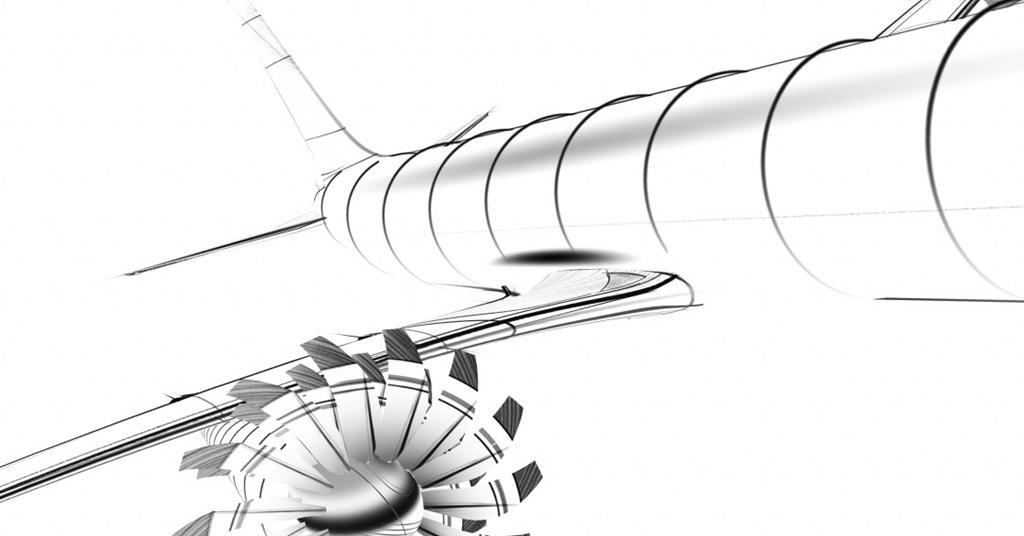

Rolls-Royce remains unconvinced that open-rotor benefit outweighs integration risk

Rolls-Royce has emphasised its scepticism over the open-rotor concept, as it unveils its ducted UltraFan…

NATO next-generation rotorcraft project closes on final requirements as Boeing re-emerges as possible bidder

A project involving six NATO members aiming to develop a next-generation military helicopter has agreed…

UK Royal Air Force advances crew training capability as delayed Boeing E-7A Wedgetail nears service entry

The UK Royal Air Force (RAF) has edged closer to reinstating its lapsed airborne early…

Croatia Airlines pressured by weak revenue growth and continuing fleet-renewal costs

Croatia Airlines’ full-year losses have doubled, a situation which the carrier attributes to weak revenue…

London City consults on shallower glideslope to enable A320neo operations

London City airport is seeking to implement a shallower glideslope of 4.49° – compared with…

GTF shop visits continue to drive commercial maintenance revenues at MTU

MTU Aero Engines is expecting continuing strong demand for powerplant maintenance, with the persisting Pratt…

Draken boosts UK ‘Red Air’ service delivery with L-159E after completing first depot-level inspection

Adversary training specialist Draken has completed a first depot-level inspection on one of the Aero…

Rolls-Royce lifts Trent engine durability-improvement target

Rolls-Royce has hiked the durability improvement target for its Trent engine time-on-wing programme, raising the…

Strong aftermarket drives up Rolls-Royce aerospace profits despite dip in engine deliveries

While supply-chain issues dragged engine deliveries down last year, Rolls-Royce’s financial performance in civil aerospace…

Airbus plots European-developed version of autonomous H145M helicopter

Airbus Helicopters is actively pursuing a domestically-developed autonomous uncrewed version of its H145M light-twin for…