Norway presses ahead with defence helicopter acquisitions, as talks continue with UK on ASW assets

Company

Legal Links

Contact

- +44 7947 753363

- contact@skylineairporttransfers.co.uk

- 6 Walsall Street Bilston Wolverhampton WV14 0AT

© Skyline Airport Transfers. Created by![]() Beaphoenix WebDesign ltd

Beaphoenix WebDesign ltd

Popular Locations:

Birmingham: Aston, Bournville, Edgbaston, Erdington, Great Barr, Hall Green, Handsworth, Harborne, Northfield, Quinton, Soho, Sutton Coldfield, Amblecote, Brierley Hill, Coseley, Cradley, Gornal, Halesowen, Kingswinford, Lye, Netherton, Sedgley, Stourbridge, Quarry Bank, Bearwood, Blackheath, Cradley Heath, Great Bridge, Old Hill, Rowley Regis, Smethwick, Tipton, Tividale, Wednesbury, West Bromwich, Balsall Common, Bickenhill, Castle Bromwich, Chelmsley Wood, Dorridge, Elmdon, Hampton in Arden, Kingshurst, Knowle, Marston Green, Meriden, Monkspath, Hockley Heath, Shirley, Aldridge, Birchills, Bloxwich, Brownhills, Darlaston, Leamore, Palfrey, Pelsall, Pheasey, Shelfield, Streetly, Willenhall, Bilston, Blakenhall, Bushbury, Compton, Ettingshall, Heath Town, Oxley, Penn, Tettenhall, Wednesfield, Burntwood, Lichfield, Cannock, Rugeley, KIDDERMINSTER, Brierly Hill,

STOURPORT-ON-SEVERN

Coventry: Allesley, Binley, Keresley, Stoke, Tile Hill

Leicester: Abbey Rise, Ashton Green, Aylestone, Beaumont Leys, Bede Island, Belgrave, Blackfriars, Braunstone, Braunstone Frith, Bradgate Heights, Clarendon Park, Crown Hills, Dane Hills, Evington, Evington Valley, Eyres Monsell, Frog Island, Goodwood, Hamilton, Highfields, Horston Hill, Humberstone, Humberstone Garden, Kirby Frith, Knighton, Mowmacre Hill, Netherhall, Newfoundpool, New Parks, North Evington, Northfields, Rowlatts Hill, Rowley Fields, Rushey Mead, Saffron, Southfields, South Knighton, Spinney Hills, Stocking Farm, Stoneygate, St. Matthew’s, St. Mark’s, St. Peters, Thurnby Lodge, West End, West Knighton, Western Park, Woodgate

Derby: Matlock, Ripley, Ashbourne, ILKESTON, SWADLINCOTE , BURTON-ON-TRENT, BAKEWELL,

ALFRETON, BELPER, HEANOR

Telford: Market Drayton, Newport, Shifnal, Broseley, Much Wenlock

Stoke: Stoke-on-Trent, Newcastle, Leek, Uttoxeter, Stone, Stafford

Worcester: Worcester, Droitwich, Pershore, Broadway, Evesham, Malvern, Tenbury Wells

Gloucester: Gloucester, Cheltenham, Stroud, Cirencester, Tewkesbury, Badminton, Berkeley, Blakeney, Chipping Campden, Cinderford, Coleford, Drybrook, Dursley, Dymock, Fairford, Lechlade, Longhope, LydbrookLydney, Mitcheldean, Moreton-in-Marsh, Newent, Newnham, Ruardean, Stonehouse, Tetbury, Westbury-on-Severn, Wotton-under-Edge.

Nottingham: Nottingham, Sutton-in-Ashfield, Mansfield, Newark, Southwell, Grantham, Sleaford

Leicester: Leicester, Hinckley, Loughborough, Melton Mowbray, Oakham Market, Harborough, Lutterworth, Wigston, Ashby-de-la-Zouch, Ibstock, Markfield

Oxford: Oxford, Kidlington, Chipping Norton, Thame, Wallingford, Didcot, Wantage, Abingdon, Banbury, Carterton, Woodstock, Bicester, Witney, Chinnor, Watlington

Chester: Chester, Deeside, Bagillt, Buckley, Holywell, Birkenhead, Preston, Wallasey, Wirral, Neston, Ellesmere Port, Prenton

Airports we serve:

BHX: Birmingham Airport

EMA: East Midlands Airport

LHR: London Heathrow Airport

MAN: Manchester Airport

LGW: London Gatwick Airport

LTN: London Luton Airport

SOU: Southampton Airport

BRS: Bristol Airport

LPL: Liverpool John Lennon Airport

LCY: London City Airport

STN: London Stansted Airport

Norway continues to analyse the options for a future anti-submarine warfare (ASW) helicopter to equip its new UK-built Type 26 frigates as the Nordic nation wrestles with multiple rotorcraft procurement programmes.

Oslo’s latest budget proposal, published on 15 October, reiterates its plans to acquire several new helicopter types in support of the army and navy, including those for ASW. Additional search and rescue (SAR) helicopters for the Ministry of Justice could also be on the cards.

Norway has been seeking a new ASW helicopter for some time since the premature retirement of its NH Industries NH90 fleet in 2022 – currently the subject of a court battle – but it had seemed to be closing in on a decision tied to the acquisition of new frigates.

In late August, Oslo said it had selected the BAE Systems Type 26 for its navy, with deliveries scheduled from 2030. However, in a surprise move, it failed to also commit to the Leonardo Helicopters AW101, which had been offered alongside the ships as part of a government-to-government package.

At the time, the Norwegian defence ministry said the exact helicopter type “has not yet been determined” and it was also exploring the possibility of “using unmanned platforms” for the mission.

Norway’s hesitancy over the AW101 – widely regarded as a strong ASW aircraft – likely stems from the UK’s uncertain long-term commitment to the Merlin, which is scheduled to exit service in 2040 at the latest, and manned aviation more generally.

The Royal Navy (RN) operates two variants of the AW101 Merlin: the HM2 is used in the ASW role, while the HC4/4A is flown by the Commando Helicopter Force as a troop transport. Some argue that a logical replacement would be new -600-series airframes, a variant already operated by Norway for SAR, which offers a significant performance gain over the earlier models.

But plans for a crewed successor to the Merlin are vague at present as the RN pursues its Maritime Aviation Transformation Strategy (MATx), which seeks to shift to unmanned platforms for most missions.

Leonardo Helicopters in the UK has also been developing the AW09-derived Proteus unmanned technology demonstrator, with a first flight scheduled for later this year. However, the platform, whose mission sets include ASW and cargo transport, is far from a fully-fledged development programme.

FlightGlobal understands that talks between the two nations are continuing in an attempt to clarify the RN’s direction of travel.

The Norwegian defence ministry says it is still considering its options, including uncrewed, adding: “This is something we will look into further, and we have a good dialogue with the United Kingdom regarding this issue.”

But there are wider considerations at play: Norway’s 14-strong NH90 fleet was mixed, serving both as ASW assets and in support of the coastguard.

Oslo has since ordered six Sikorsky MH-60R Seahawks as replacements for the coastguard mission, potentially opening the door to a related purchase for the ASW requirement.

“Norwegian personnel are currently undergoing an exchange to Denmark to gain experience with the MH-60R Seahawk and maintain expertise within maritime helicopter operations,” the budget documents disclose.

But the new Seahawks will not arrive for some years yet: the defence ministry says the first delivery is expected in the 2026-2027 timeframe, and the helicopters will be “phased in during the period 2027-2030.”

They are also not cheap: Norway has allocated NKr13.9 billion ($1.3 billion) for the six aircraft plus three years of support.

In the interim, all eyes are on the Royal Norwegian Air Force’s (RNoAF’s) 16 AW101 ‘SAR Queen’ long-range search and rescue helicopters.

Procured by the Ministry of Justice, but flown by the RNoAF, the SAR assets are achieving high levels of availability and operational performance.

“The new helicopters have much better range, greater speed, new technology and are better able to operate in bad weather,” the justice ministry’s budget documents state.

“[The] SAR Queen can fly directly to the target instead of flying around the coast or following valleys and fjords in adverse weather conditions. The new helicopters give Norway increased readiness.”

Maximum range with standard fuel tanks is 735nm (1,360km), according to the airframer’s specifications.

Norway is considering whether to exercise some or all of the six options it holds for the UK-built type as part of a move to add an additional base in Tromso to the SAR Queen’s network.

At present, the operation in Tromso is run by a civil provider, with that contract ending in 2029. A decision on the AW101 options is due by year-end.

Norway has set aside NKr533 million in 2026 for “investments in the purchase of new rescue helicopters and measures to facilitate infrastructure”, it states, with the project’s total cost pegged at NKr17.9 billion.

Should Norway pick the AW101 or MH-60R for the ASW mission, it would in either case benefit from maintenance and spare part commonality with its other fleets.

Oslo may also be leaning towards another UH-60 derivative – the HH-60W Jolly Green II – to support its special forces as a replacement for the current Bell 412 fleet.

US Department of State clearance for a $2,6 billion, nine-helicopter deal via the Foreign Military Sales process was received earlier this year.

However, Norway has yet to formally commit to the HH-60W, with assessment of options continuing.

The US Air Force is the primary customer for the combat search and rescue helicopter. It is unclear whether recent moves to switch more than 20 airframes to a VIP transport role – seen in some quarters as a downbeat reflection of the service’s commitment – will have any impact on Norway’s thinking.

Source link

Share This:

skylinesmecher

Plan the perfect NYC Memorial Day weekend

Pack only what you need and avoid overpacking to streamline the check-in and security screening…

LA’s worst traffic areas and how to avoid them

Consider using alternative routes, such as Sepulveda Boulevard, which runs parallel to the 405 in…

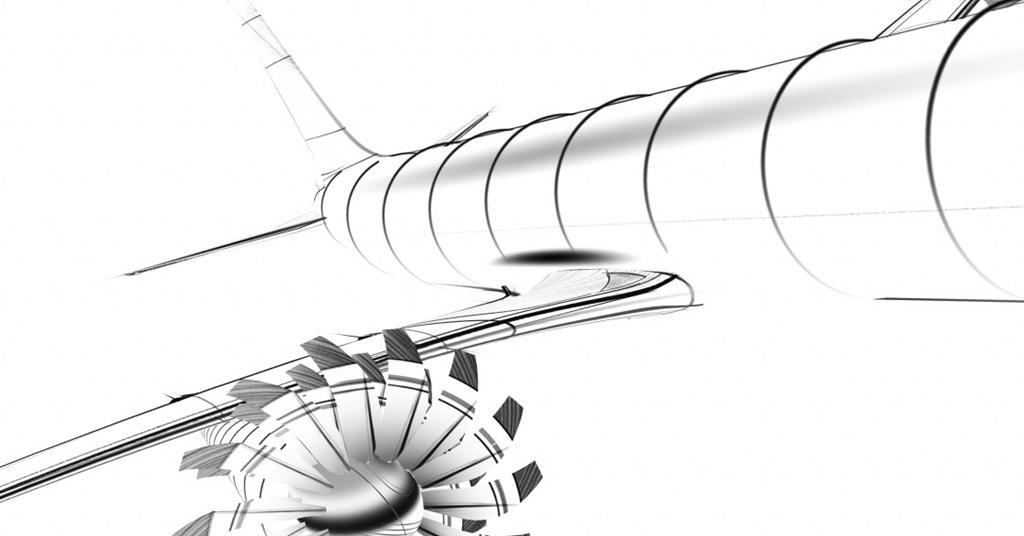

Rolls-Royce teases UltraFan 30 features as demonstrator heads for design freeze

Rolls-Royce has shown off a full-scale mock-up of its proposed UltraFan 30 engine aimed at…

Rolls-Royce remains unconvinced that open-rotor benefit outweighs integration risk

Rolls-Royce has emphasised its scepticism over the open-rotor concept, as it unveils its ducted UltraFan…

NATO next-generation rotorcraft project closes on final requirements as Boeing re-emerges as possible bidder

A project involving six NATO members aiming to develop a next-generation military helicopter has agreed…

UK Royal Air Force advances crew training capability as delayed Boeing E-7A Wedgetail nears service entry

The UK Royal Air Force (RAF) has edged closer to reinstating its lapsed airborne early…

Croatia Airlines pressured by weak revenue growth and continuing fleet-renewal costs

Croatia Airlines’ full-year losses have doubled, a situation which the carrier attributes to weak revenue…

London City consults on shallower glideslope to enable A320neo operations

London City airport is seeking to implement a shallower glideslope of 4.49° – compared with…

GTF shop visits continue to drive commercial maintenance revenues at MTU

MTU Aero Engines is expecting continuing strong demand for powerplant maintenance, with the persisting Pratt…

Draken boosts UK ‘Red Air’ service delivery with L-159E after completing first depot-level inspection

Adversary training specialist Draken has completed a first depot-level inspection on one of the Aero…

Rolls-Royce lifts Trent engine durability-improvement target

Rolls-Royce has hiked the durability improvement target for its Trent engine time-on-wing programme, raising the…

Strong aftermarket drives up Rolls-Royce aerospace profits despite dip in engine deliveries

While supply-chain issues dragged engine deliveries down last year, Rolls-Royce’s financial performance in civil aerospace…