Southwest’s feud with Elliot heats up ahead of investor day | News

Company

Legal Links

Contact

- +44 7947 753363

- contact@skylineairporttransfers.co.uk

- 6 Walsall Street Bilston Wolverhampton WV14 0AT

Recent Posts

© Skyline Airport Transfers. Created by![]() Beaphoenix WebDesign ltd

Beaphoenix WebDesign ltd

Popular Locations:

Birmingham: Aston, Bournville, Edgbaston, Erdington, Great Barr, Hall Green, Handsworth, Harborne, Northfield, Quinton, Soho, Sutton Coldfield, Amblecote, Brierley Hill, Coseley, Cradley, Gornal, Halesowen, Kingswinford, Lye, Netherton, Sedgley, Stourbridge, Quarry Bank, Bearwood, Blackheath, Cradley Heath, Great Bridge, Old Hill, Rowley Regis, Smethwick, Tipton, Tividale, Wednesbury, West Bromwich, Balsall Common, Bickenhill, Castle Bromwich, Chelmsley Wood, Dorridge, Elmdon, Hampton in Arden, Kingshurst, Knowle, Marston Green, Meriden, Monkspath, Hockley Heath, Shirley, Aldridge, Birchills, Bloxwich, Brownhills, Darlaston, Leamore, Palfrey, Pelsall, Pheasey, Shelfield, Streetly, Willenhall, Bilston, Blakenhall, Bushbury, Compton, Ettingshall, Heath Town, Oxley, Penn, Tettenhall, Wednesfield, Burntwood, Lichfield, Cannock, Rugeley, KIDDERMINSTER, Brierly Hill,

STOURPORT-ON-SEVERN

Coventry: Allesley, Binley, Keresley, Stoke, Tile Hill

Leicester: Abbey Rise, Ashton Green, Aylestone, Beaumont Leys, Bede Island, Belgrave, Blackfriars, Braunstone, Braunstone Frith, Bradgate Heights, Clarendon Park, Crown Hills, Dane Hills, Evington, Evington Valley, Eyres Monsell, Frog Island, Goodwood, Hamilton, Highfields, Horston Hill, Humberstone, Humberstone Garden, Kirby Frith, Knighton, Mowmacre Hill, Netherhall, Newfoundpool, New Parks, North Evington, Northfields, Rowlatts Hill, Rowley Fields, Rushey Mead, Saffron, Southfields, South Knighton, Spinney Hills, Stocking Farm, Stoneygate, St. Matthew’s, St. Mark’s, St. Peters, Thurnby Lodge, West End, West Knighton, Western Park, Woodgate

Derby: Matlock, Ripley, Ashbourne, ILKESTON, SWADLINCOTE , BURTON-ON-TRENT, BAKEWELL,

ALFRETON, BELPER, HEANOR

Telford: Market Drayton, Newport, Shifnal, Broseley, Much Wenlock

Stoke: Stoke-on-Trent, Newcastle, Leek, Uttoxeter, Stone, Stafford

Worcester: Worcester, Droitwich, Pershore, Broadway, Evesham, Malvern, Tenbury Wells

Gloucester: Gloucester, Cheltenham, Stroud, Cirencester, Tewkesbury, Badminton, Berkeley, Blakeney, Chipping Campden, Cinderford, Coleford, Drybrook, Dursley, Dymock, Fairford, Lechlade, Longhope, LydbrookLydney, Mitcheldean, Moreton-in-Marsh, Newent, Newnham, Ruardean, Stonehouse, Tetbury, Westbury-on-Severn, Wotton-under-Edge.

Nottingham: Nottingham, Sutton-in-Ashfield, Mansfield, Newark, Southwell, Grantham, Sleaford

Leicester: Leicester, Hinckley, Loughborough, Melton Mowbray, Oakham Market, Harborough, Lutterworth, Wigston, Ashby-de-la-Zouch, Ibstock, Markfield

Oxford: Oxford, Kidlington, Chipping Norton, Thame, Wallingford, Didcot, Wantage, Abingdon, Banbury, Carterton, Woodstock, Bicester, Witney, Chinnor, Watlington

Chester: Chester, Deeside, Bagillt, Buckley, Holywell, Birkenhead, Preston, Wallasey, Wirral, Neston, Ellesmere Port, Prenton

Airports we serve:

BHX: Birmingham Airport

EMA: East Midlands Airport

LHR: London Heathrow Airport

MAN: Manchester Airport

LGW: London Gatwick Airport

LTN: London Luton Airport

SOU: Southampton Airport

BRS: Bristol Airport

LPL: Liverpool John Lennon Airport

LCY: London City Airport

STN: London Stansted Airport

Southwest Airlines’ increasingly acrimonious public feud with minority shareholder Elliot Investment Management has heated up a notch just days before the carrier is scheduled to update investors on its strategy.

The private equity firm, which now holds 11% of the Dallas-headquartered airline’s outstanding shares, early on 25 September published a strongly worded letter to fellow investors accusing the Southwest board of incompetence.

It calls for a special investor meeting in the coming weeks to “make you aware of certain defensive actions that Southwest’s leaders are taking, apparently in an attempt to disenfranchise shareholders and evade accountability for their poor performance”.

Elliot, based in West Palm Beach, Florida, says the carrier’s management and board have made “a chaotic series of defensive actions”, and chose ”a go-it-alone path with the goal of obstructing a leadership change that is urgently needed”. It calls the airline’s announcement of recent changes in an attempt to return to profitability “half-baked”.

”Now we are seeing reports that Southwest executives are warning employees of ‘difficult decisions’ ahead that could adversely affect workers, which are supposedly being made in response to demands from Elliott Management,” the company says.

”Whatever ‘difficult decisions’ management have decided must be made, they are the product of a failed management team that has delivered years of deteriorating performance and is now taking any action – no matter how short-sighted – that they believe will preserve their own jobs.”

Southwest Airlines wasted no time in responding to the letter. It says it has attempted to “reach a constructive resolution” with Elliott in recent weeks, but that the investor has “remained entrenched” in its position.

These attempts include “over a dozen phone calls with Elliott representatives, several in-person meetings and an offer for Elliott to participate in the company’s board refreshment process and understand its views on Southwest’s business and strategy”, Southwest says.

“It’s unfortunate that Elliott has not only completely failed to engage constructively, but today has continued its pattern of launching public ambushes and is seeking to disrupt Southwest’s upcoming investor day,” the company adds.

Southwest plans to hold its investor day in Dallas on 26 September.

Earlier this month, Southwest announced changes to its 15-member board of directors, in an attempt to assuage the pressure coming from Elliott. Six directors will retire in November, while executive chairman and former chief executive Gary Kelly will retire next year. The airline also brought in long-time industry executive Rakesh Gangwal, co-founder of India’s InterGlobe Aviation, which operates under the IndiGo airline brand.

The six resigning directors are David Biegler, Veronica Biggins, US Senator Roy Blunt, William Cunningham, Thomas Gilligan and Jill Soltau. Southwest expects the board to be reduced to 13 members following the exodus. In July, it adopted a strategy aimed at fending off Elliott when it approved a rights plan that lets stockholders buy shares at a 50% discount should any entity acquire at least 12.5% of the stock.

At the time, Southwest’s board reiterated its continuing support of current chief Bob Jordan, maintaining that it is “confident that there is no better leader… to successfully execute Southwest Airlines’ robust strategy to evolve the airline and enhance sustainable shareholder value”.

In addition, in July, Southwest said it will abandon its open-seating policy and add more extended-legroom seats for sale at a premium.

Elliot has called these changes “too little, too late”.

Elliot, for its part, in August put forward a slate of its own board nominees, which include former airline chiefs David Cush and Gregg Saretsky, to replace the incumbents, which it sees as “profoundly out of touch” with investors following a series of blunders earlier this year.

Southwest had long been among the USA’s most-profitable airlines – universally known for eschewing baggage and reservation change fees and for pioneering a low-cost-carrier model that numerous airlines have since emulated. But it has stumbled of late, rattled by increased competition, including from newer “ultra-low-cost” carriers like Frontier Airlines and from “basic” economy tickets offered by major carriers. Southwest has also been hamstrung by significant delays from Boeing in delivering new 737 Max jets.

“The urgency of management and board change at Southwest could not be clearer,” Elliot writes in its most recent attack on Southwest’s management. “In the coming weeks, we will be formally requesting a special meeting to provide you with a choice between the new directors that we have put forward – who we believe possess the qualifications and skills to guide Southwest to a brighter future – or a board that lacks relevant expertise and has pre-committed itself to supporting failed CEO Bob Jordan.”

Southwest’s net profit fell 46% in the April-June period to $367 million. Operating profit was down 50% at $398 million on revenue up 5% at $7.5 billion. It will publish third-quarter results in mid-October.

Source link

Share This:

admin

Plan the perfect NYC Memorial Day weekend

Pack only what you need and avoid overpacking to streamline the check-in and security screening…

LA’s worst traffic areas and how to avoid them

Consider using alternative routes, such as Sepulveda Boulevard, which runs parallel to the 405 in…

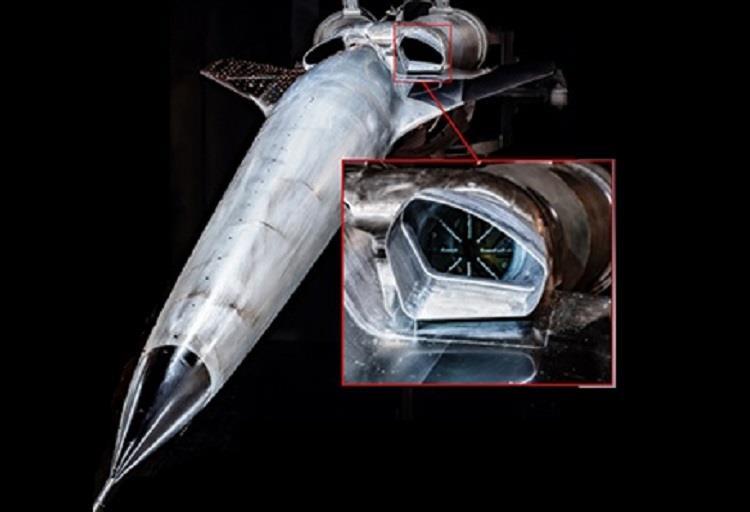

Engine tests progress in Russian civil supersonic demonstrator research programme

Russian research efforts to create a new supersonic civil aircraft demonstrator have edged forward with…

United Aircraft to display import-substituted SJ-100 and Il-114-300 at Indian air show

United Aircraft is to display its import-substituted Yakovlev SJ-100 and the new Ilyushin Il-114-300 internationally…

Higher fares and economic slump stalling domestic air travel recovery: Swedish regulator

Sweden’s transport regulator believes an economic downturn, coupled with increasing air fares – partly through…

Qinetiq gets follow-on engineering support contract for UK Royal Air Force’s Eurofighter Typhoon fleet

Qinetiq has secured a five-year contract extension from the UK Ministry of Defence to provide…

Germany awards Top Aces 10-year contract extension for adversary air training services

Top Aces has landed a 10-year contract extension worth a potential €420 million ($490 million)…

France and Spain plot future upgrades for special forces NH90 helicopters with key development contracts

France and Spain look set to significantly enhance the ability of some of their NH…

Emirates highlights Asia-Pacific connection options as it opens Helsinki route

Middle Eastern carrier Emirates is to deploy Airbus A350s on a new route to the…

TAP to set up maintenance centre as part of Porto investment

Portuguese carrier TAP is to establish a maintenance centre at Porto, in the north of…

Denmark deploys troops to Greenland amid US annexation threats

Amid threats by US President Donald Trump to annex Greenland, Denmark and several European allies…

Daher reveals TBM 980 with upgrade to Garmin Prime touchscreen cockpit | News

Daher has unveiled the TBM 980 as the sixth and latest version of its TBM…